3. The Evals Gap¶

It doesn’t matter how beautiful your theory is,

it doesn’t matter how smart you are.

If it doesn’t agree with experiment, it’s wrong.—Richard Feynman

3.1. Introduction¶

The advent of LLMs marks a pivotal shift in the landscape of software development, testing and verification. Unlike traditional software systems, where deterministic outputs are the norm, LLMs introduce a realm of non-deterministic and generative behaviors that challenge conventional software engineering paradigms. This shift is not merely a technical evolution but a fundamental transformation in how we conceive, build, and assess software products.

For those entrenched in traditional methodologies, the transition to LLM-driven systems may seem daunting. However, ignoring this change is not an option. The reliance on outdated testing frameworks that fail to account for the probabilistic nature of LLMs will inevitably lead to significant setbacks.

To overcome these challenges, it is imperative to embrace the complexities of LLMs with a proactive mindset. This involves developing robust evaluation frameworks up-front that incorporate the generative nature of LLM-based software development while fostering a culture of continuous change, learning and adaptation.

3.2. Non-Deterministic Generative Machines¶

One of the most fundamental challenges when building products with LLMs is their generative and non-deterministic nature. Unlike traditional software systems where the same input reliably produces the same output, LLMs can generate novel text that may not exist in their training data, and produce different responses each time they’re queried - even with identical prompts and input data. This behavior is both a strength and a significant engineering and product challenge.

When you ask an LLM the same question multiple times, you’ll likely get different responses. This isn’t a bug - it’s a fundamental feature of how these models work. The “temperature” parameter, which controls the randomness of outputs, allows models to be creative and generate diverse responses. However, this same feature makes it difficult to build reliable, testable systems.

Consider a financial services company using LLMs to generate investment advice. The non-deterministic nature of these models means that:

The same input data could yield different analysis conclusions

Regulatory compliance becomes challenging to guarantee

User trust may be affected by inconsistent responses

Testing becomes exceedingly more complex compared to traditional software

The primary source of non-determinism in LLMs comes from their sampling strategies. During text generation, the model:

Calculates probability distributions for each next token

Samples from these distributions based on temperature settings

Uses techniques like nucleus sampling [Holtzman et al., 2020] or top-k sampling to balance creativity and coherence

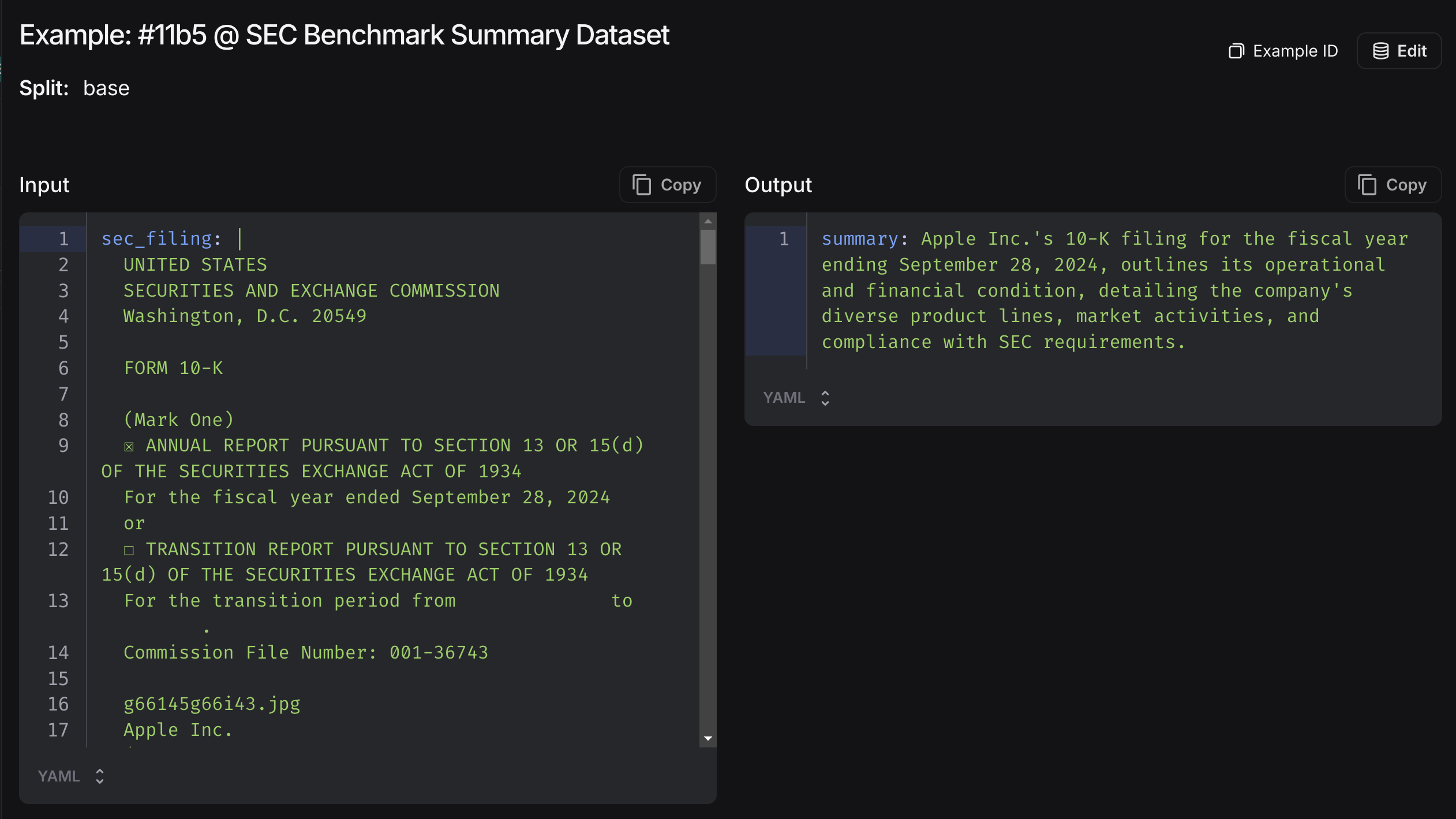

In this simple experiment, we use an LLM to write a single-statement executive summary from an input financial filing. We observe that even a simple parameter like temperature can dramatically alter model behavior in ways that are difficult to systematically assess. At temperature 0.0, responses are consistent but potentially too rigid. At 1.0, outputs become more varied but less predictable. At 2.0, responses can be wildly different and often incoherent. This non-deterministic behavior makes traditional software testing approaches inadequate.

from dotenv import load_dotenv

import os

# Load environment variables from .env file

load_dotenv()

from openai import OpenAI

import pandas as pd

from typing import List

def generate_responses(

model_name: str,

prompt: str,

temperatures: List[float],

attempts: int = 3

) -> pd.DataFrame:

"""

Generate multiple responses at different temperature settings

to demonstrate non-deterministic behavior.

"""

client = OpenAI()

results = []

for temp in temperatures:

for attempt in range(attempts):

response = client.chat.completions.create(

model=model_name,

messages=[{"role": "user", "content": prompt}],

temperature=temp,

max_tokens=50

)

results.append({

'temperature': temp,

'attempt': attempt + 1,

'response': response.choices[0].message.content

})

# Display results grouped by temperature

df_results = pd.DataFrame(results)

for temp in temperatures:

print(f"\nTemperature = {temp}")

print("-" * 40)

temp_responses = df_results[df_results['temperature'] == temp]

for _, row in temp_responses.iterrows():

print(f"Attempt {row['attempt']}: {row['response']}")

return df_results

MAX_LENGTH = 10000 # We limit the input length to avoid token issues

with open('../data/apple.txt', 'r') as file:

sec_filing = file.read()

sec_filing